in Charlie Wilson's War and was played on the screen by Julia Roberts. After her romance with Wilson, she later married a rich businessman named Davis.

in Charlie Wilson's War and was played on the screen by Julia Roberts. After her romance with Wilson, she later married a rich businessman named Davis.I began my research on her long before George Crile wrote Charlie Wilson's War. More accurately, I was researching her husband, because he was ran a natural gas corporation for years before it became Enron. Already teetering on the bring in August 2001, Enron used as its excuse for its global collapse the destruction of the World Trade Center on September 11.

You can call me a cynical skeptic if you like.

When I first heard of Joanne Herring, I was doing research into an informally organized political group that met in Houston, Texas and was often given credit for providing the funds that elected Lyndon Johnson to Congress and, later, to the U.S. Senate and the Presidency.

Herring 's husband was ancillary to that group, not an actual member, and he came to my attention once he moved the corporate headquarters of Houston Natural Gas, out of the Petroleum Building--where it had been located since 1927--and into 1200 Travis Street, an office building across the street a few blocks to the north from Houston's largest department store, then called Foley's.

|

| Petroleum Building, 1314 Texas Ave. |

Robert Ray Herring began working for Houston Natural Gas (HNG) Company in 1963, when a corporation he had set up in 1958 to build natural gas pipelines (Valley Gas Corp.) was bought out by HNG, and he became president in 1967. Herring's previous employer had been Fish Engineering owned by Ray C. Fish, the largest stockholder in El Paso Natural Gas. Fish also founded Pacific Northwest Pipeline Co. which built a pipeline from the San Juan Basin of Colorado and Artesia, New Mexico to Puget Sound. Fish died in 1962, at about the time Valley Gas Company was purchased by HNG.

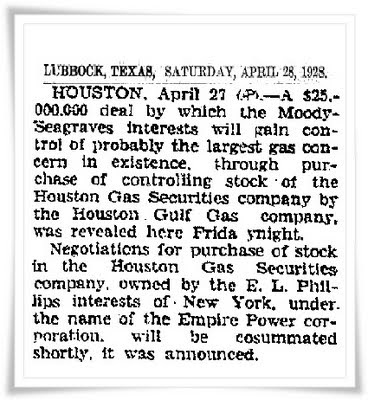

For many years Houston Gas & Fuel (the securities of which were held by Houston Gas Securities corporation) had produced the natural gas bought and distributed by the HNG Co. to Houston consumers. Consolidation began in 1928 when the stock of Houston Gas Securities, then owned by Empire Power of New York, was bought by a local company composed of William L. Moody, III and Odie R. Seagraves.

|

| Houston Gas Securities and Empire Power Corp |

Completed by the end of March 1930, the consolidation was summarized by Time Magazine as follows:

Last week was announced a major gas consolidation in the southwest. Companies affected are Louisiana Gas & Fuel Co., a subsidiary of Electric Power & Light (which in turn is controlled by Sidney Zollicoffer Mitchell's Electric Bond & Share Co.) and United Gas Co., which Odie Richard Seagraves organized in 1928. Mr. Seagraves, together with William Lewis Moody III, constitute what is commonly known as the Moody-Seagraves interests.

Able promoters, Mr. Moody and Mr. Seagraves have developed many a Texan and Southwestern industry, including hotels, cosmetics, railroads. Mr. Seagraves has a large ranch at Kerrville, Tex. Although the new gas company will be organized as a subsidiary of Electric Power and Light, Messrs. Seagraves and Moody retain a large stock interest and will in all probability be represented on the directorate.

Electric Bond & Share will have a controlling interest in the as yet unchristened new company, which will also purchase from Standard Oil of New York the natural gas properties in Texas and Louisiana owned by Magnolia Gas Co., a Standard subsidiary....Significance of this consolidation lies:

- in the extended influence of Electric Bond & Share;

- in the drift of the natural gas business away from its petroleum and toward its public utility affiliations;

- in the probable status of the newly formed company as the first of many far-reaching consolidations which should ultimately create a super-gas situation comparable to the already existing super-power systems in the electric field.

According to Griffin Smith, Jr. in an article, "Empires of Paper," in Texas Monthly (November 1973), in the 1930s:

Vinson Elkins...was a 'four-client firm'-- those clients being:

All but the last one were headquartered in Houston. Judge Elkins saw another resource, however, and exploited it brilliantly. The local independent oil men had never catered to Baker & Botts, thinking the Baker firm was too close to the big oil companies and Eastern finance. The Judge, wearing his banker's hat as president of First [City] National, gave them loans; VE in turn did their legal work...This neat little arrangement catapulted VE into the big time.

- Great Southern Life Insurance Company,

- Moody-Seagraves,

- the production end of United Gas Corporation, and

- Pure Oil Corporation.

In December 1965 42% of United Gas Corporation stock was sold to Pennzoil Corporation. Only four years earlier a subsidiary, Shreveport-based United Gas Pipe Line, among other companies, had negotiated long-term contracts with Texas Eastern Transmission Co. allowing the latter company, formed at the end of WWII by George and Herman Brown and other Houston associates, to expand.

Pennzoil was formed in July 1963 when South Penn Oil shareholders approved a merger with Zapata Petroleum and Stetco Petroleum, allowing Zapata stockholders to exchange four shares of Zapata common stock for one share of Pennzoil stock and Stetco shareholders to exchange seven for one. In 1959 Zapata Petroleum had split off part of the company into Zapata Offshore, with the new stock going to George Bush, who previously had been a shareholder of the former company; he therefore obtained no interest in either Pennzoil or United Gas by virtue of the mergers that occurred subsequent to the Zapata split.

HNG had bid on long-term contracts to supply gas to other major cities in Texas, but it was being bombarded at that time by competition waged by a Texan named Oscar Wyatt through his corporation, Coastal States Gas, particularly in Corpus Christi, San Antonio, and Austin, who claimed he could save the cities money.

Byrd also went into banking by acquiring the stock of the Montrose National Bank (located at 3400 Montrose Street), changing the name to Central National Bank.

The majority ownership of the bank was controlled at the time by Hy Byrd's corporation, Gulf Interstate Corp.[2] During this time, Houston Natural Gas was under the management and control of a variety of businessmen. Hy Bird would be succeeded as president in 1967 by Robert R. Herring.

A noted architectural firm was hired to design an office building for the bank at 2100 Travis at Gray Street, and other businessmen who had bought stock in the bank located their own businesses in the building. Hy Byrd was president of the bank, and another person involved in Central National's banking syndicate was L.E. Cowling, (responsible for the founding and initial capitalization of Alabama National Life Insurance Company, Capital National Life Insurance Company of Houston, Texas, and Southern States Life Insurance ) later a defendant named in an intricate scheme of corporate insider loans in the Shell v. Hensley case, 430 F.2nd 819 (1970).

William Wayne Caudill had been acclaimed for his school building design before he moved from College Station to Houston in 1959--senior partner of the Caudill Rowlett Scott (CRS) firm of architects, which would eventually become CRS Sirrine. Caudill was also a professor from 1961 to 1969 at Rice University where he also served as chairman of the department of architecture. The Rice professor was chosen to design the bank's office building.

HNG had bid on long-term contracts to supply gas to other major cities in Texas, but it was being bombarded at that time by competition waged by a Texan named Oscar Wyatt through his corporation, Coastal States Gas, particularly in Corpus Christi, San Antonio, and Austin, who claimed he could save the cities money.

In 1955 the firm became the Coastal States Gas Producing Company, engaged in collecting and distributing natural gas from the South Texas oilfields. In the early 1960s Coastal purchased the Sinclair Oil Corpus Christi refinery and pipeline network and established a subsidiary called Lo-Vaca Gathering to supply natural gas to Texas cities and utilities. When Lo-Vaca curtailed its gas supplies and raised prices during the energy crisis of the early 1970s, customers sued Coastal. Regulators ordered the subsidiary to refund $1.6 billion in 1977, and Coastal spun off Lo-Vaca as Valero Energy to finance the settlement.Newspaper articles from that early era tell us that Hy Byrd, who grew up in Port Arthur, Texas, had become wealthy from building the pipelines to carry gas from the south to northern areas and that in 1962 he decided to "branch out into the aerospace industry"--a decision that came at the same time Senator Lyndon Johnson was using his influence in locating an arm of the NASA program in Houston.

Byrd also went into banking by acquiring the stock of the Montrose National Bank (located at 3400 Montrose Street), changing the name to Central National Bank.

The majority ownership of the bank was controlled at the time by Hy Byrd's corporation, Gulf Interstate Corp.[2] During this time, Houston Natural Gas was under the management and control of a variety of businessmen. Hy Bird would be succeeded as president in 1967 by Robert R. Herring.

A noted architectural firm was hired to design an office building for the bank at 2100 Travis at Gray Street, and other businessmen who had bought stock in the bank located their own businesses in the building. Hy Byrd was president of the bank, and another person involved in Central National's banking syndicate was L.E. Cowling, (responsible for the founding and initial capitalization of Alabama National Life Insurance Company, Capital National Life Insurance Company of Houston, Texas, and Southern States Life Insurance ) later a defendant named in an intricate scheme of corporate insider loans in the Shell v. Hensley case, 430 F.2nd 819 (1970).

|

| 2100 Travis - Central Square |

During both the Johnson and Nixon administrations, Caudill was appointed to federal government advisory commissions, most notably tapped to be "architectural consultant to the Department of State on foreign buildings" from 1974-79 for President Gerald Ford's administration. The CRS firm's history is recounted below:

In 1971, the first year it publicly reported revenues and profits, CRS had revenues of $8.79 million and net income of $955,000, up from $6.465 million and $500,000 the year before. In 1972, CRS made its first major post-public offering acquisition, buying A.A. Mathews, a construction engineering firm specializing in tunnel design with offices in Los Angeles, New York, Washington, D.C., and Rome. With this stroke CRS moved into the civil engineering market.

In the late 1960s, as the boom in school construction started to wane, CRS branched out into the health care market and broadened its planning and design capabilities. To adapt to its new focus on design, the firm renamed itself again in 1970, incorporating in Delaware and becoming CRS Design Associates. The following year CRS made its initial public offering of 350,000 shares at $12 a share on the American Exchange. With the resultant infusion of cash, CRS began a strategy of expansion, and it immediately began acquiring other businesses, especially in construction management and design. Under the leadership of Chairman Thomas A. Bullock, one of the original partners, CRS would acquire ten companies over the next eleven years; these companies were businesses as diverse as interior design, water resource engineering, and pulp and paper, and their acquisition transformed the nature, size, and role of the company.

|

| Stock Issued in 1971 by Underwood, Neuhaus & Co. of Houston, TX |

In 1971, the first year it publicly reported revenues and profits, CRS had revenues of $8.79 million and net income of $955,000, up from $6.465 million and $500,000 the year before. In 1972, CRS made its first major post-public offering acquisition, buying A.A. Mathews, a construction engineering firm specializing in tunnel design with offices in Los Angeles, New York, Washington, D.C., and Rome. With this stroke CRS moved into the civil engineering market.

The same year, CRS also bought a water resources engineering company, Stevens, Thompson & Runyan, Inc., which had offices in Oregon, Washington, and Idaho, for 232,000 common shares and $1.65 million in cash. With these acquisitions, CRS's businesses boomed. By 1973, revenues totalled $17.1 million and brought the firm a net income of $1.464 million.

While Hy Byrd chaired Gulf Interstate, the company also purchased a 40% interest in Kenneth Schnitzer's office building at 1200 Travis Street (between Polk and Dallas Streets)--called "the Houston Natural Gas Building" for its core tenant. Across the street from 1200 Travis, Gulf Interstate also acquired a leasehold interest in the Americana Building which had several floors for parking, leased to Foley's Department Stores (now Macy's) on the other side of Travis Street.

According to an April 24, 1977 Houston Chronicle:

In 1973, CRS and a joint venture partner, McGaughy, Marshall & McMillan, were awarded one of the largest Middle Eastern projects ever, to provide full architectural and engineering services for the King Abdulaziz Military Academy near Riyadh. By 1976, the firm had 761 employees, and revenues of $33 million, with a net income of $2.3 million. As the firm brought in more construction and engineering contracts, the numbers continued to rise. In 1979, the firm had $50 million in revenues and $2.85 million in net income.

In 1978, CRS acquired Clark, Dietz & Associates-Engineers, an Illinois-based civil engineering firm that specialized in environmental engineering, for $5.25 million. That year CRS melded the four engineering firms it had purchased in the last five years into one, STRAAM Engineers. CRS continued to develop its international business, completing massive works at King Fahad University in Saudi Arabia. Indeed, in the 1970s, about 70 percent of CRS's revenue derived from international orders, most of which came from building schools, hospitals, and other institutions in the Middle East.

Also in 1978, Saudi businessman Ghaith Pharaon bought a large stake in CRS, buying about 20 percent of the firm's shares at about $20 per share. Although he became the firm's biggest shareholder, the eight original partners still owned a larger share between them, and were basically left in control. But changing conditions in the world economy and marketplace forced CRS to transform itself in the 1980s. It went into the decade heavily reliant on foreign construction business. But by the end of the decade, it would focus more on domestic design and power generation.

Military orders would continue to play an important role in the company's growth in the 1980s, just as they had in the 1970s. In 1980 CRS received a contract of about $56 million from the U.S. Air Force to provide furnishings and equipment for the Saudi Arabian F-15 aircraft program. And the following year CRS received a subcontract to formulate the master plan and construction logistics planning for an MX missile base in the western United States, which contributed significantly to the firm's revenues of $76 million and income of $5.25 million in 1981.

That same year CRS acquired Geren Associates, an architectural and engineering firm based in Fort Worth, Texas. To develop its domestic construction business, CRS bought four general contracting firms the following year: Metro Southwest Construction, based in Dallas, and Western Empire Construction, Colo-Macco, and Summit Constructors, all of which were based in Denver. This move greatly expanded CRS's regional coverage.

By 1981 orders from the Middle East had slipped while other areas of business had grown, and only one quarter of CRS's revenues came from projects in the Middle East.

Still, the 1980s brought lucrative Middle Eastern contracts to CRS. Between 1982 and 1987, CRS managed a five-member international consortium of firms that planned, designed, and did construction management for a $2.1 billion project for Saudi Arabia's Ministry of the Interior to provide 12,000 housing units.

In 1982, CRS began acquisition talks with J.E. Sirrine, a privately-held mill architect and engineering company based in South Carolina that had been in existence since 1902. But CRS canceled the talks in March 1982. In 1983, though, the talks were revived and the sale went through. Sirrine has been CRS's most important acquisition, and it has helped change the direction of the company. At the time, Sirrine's main appeal was that it had a large domestic business, and that it represented new geographic and business areas. Sirrine provided engineering services to the growing pulp and paper, tobacco and chemicals business in the southeastern United States. More importantly, though, Sirrine was a major power plant designer. After the acquisition, in October 1983, CRS Group formally changed its name to CRS Sirrine, Inc.

While Hy Byrd chaired Gulf Interstate, the company also purchased a 40% interest in Kenneth Schnitzer's office building at 1200 Travis Street (between Polk and Dallas Streets)--called "the Houston Natural Gas Building" for its core tenant. Across the street from 1200 Travis, Gulf Interstate also acquired a leasehold interest in the Americana Building which had several floors for parking, leased to Foley's Department Stores (now Macy's) on the other side of Travis Street.

According to an April 24, 1977 Houston Chronicle:

Over the past several years, the firm [Gulf Interstate] has been going through the motions involved in establishing a business relationship with developing Arab petronations. At present an Arab representative "maintains a presence" for the company by officing at a residential villa Gulf Interstate has acquired in Al Khobar, Saudi Arabia. * * * * In the early 1950s . . . "a pipeline from Louisiana to Ohio was, in essence, promoted by Hy Byrd (a private investor currently on the Gulf Interstate board) and others to deliver gas to Columbia Gas in Ohio.The obvious thing happened: Columbia merged with Gulf Interstate Pipeline and took it over," says Wells.

The engineering company Gulf Interstate Pipeline had formed, however, turned out to be an unwanted stepchild for Columbia's purposes.

In June, 1958, therefore, Gulf Interstate Co. was spun off with Gulf Interstate Engineering as its subsidiary.

"Part of the spinoff included the rights to process all the gas on the pipeline," Wells said. This right was sold at the turn of the decade [1960] to what is now Allied Chemical.

"This gave Gulf Interstate two principal assets," said Wells: "$4 million and an engineering company." * * * The $4 million . . . went mostly into Houston real estate.

According to the Funding Universe website, its history is further detailed as follows:

Gulf Interstate was involved in the construction of the $200 million Transwestern Pipeline, which extended from west Texas to California and was completed in 1960. The company continued to flourish in engineering, gaining a reputation as an innovator in this field. Gulf Interstate engineers designed and oversaw the construction of the world's first long-distance ammonia pipeline, the Gulf Central Pipeline, which was completed in 1970. Now a $7 million company, Gulf Interstate looked to diversify. Operating pipelines was a natural offshoot of its expertise, but as early as 1960 the company's management had begun investing in real estate, becoming especially interested in high-rise Houston office buildings.

It owned the Americana Building, a ten-story building that also housed its headquarters, located in the heart of Houston's business center. Across the street was the Houston Natural Gas Building, a 28-story structure in which Gulf Interstate held a 40 percent interest. The company also owned the Gulf Credit Card Center, which it leased to the Gulf Oil Company for its credit card operations. Moreover, Gulf Interstate acquired a 10 percent stake in some 3,300 undeveloped acres near Houston International [Now George H.W. Bush] Airport, as well as some property in Buffalo, New York. Gulf Interstate became involved in the marine terminal business, operating a "tank farm" in South Shield, England. The facility included 26 tanks to store gas and oil, as well as docking facilities.

It was also in the early 1970s during Gulf Interstate's diversification efforts that it became involved in the support vessel business that would one day evolve into GulfMark. The company acquired a 49 percent interest in a Louisiana company called Gulf Overseas Marine Corporation. The remaining stock was owned by a single individual. Gulf Overseas provided utility boats that supplied the 100 drilling rigs that operated in the Gulf of Mexico. In addition it supplied crews for anchor handling duties. With each rig in the Gulf requiring at least two support boats, the company recognized a growing opportunity. Gulf Interstate also took a 50 percent ownership position in a subsidiary formed in 1973, Gulf Overseas Shipbuilding Corporation, to build two deep sea tug boats, with the possibility of additional future construction.

Gulf Overseas would be in need of these new vessels because in 1974 it accepted an attractive offer from a foreign company and sold its three-vessel fleet, generating an after-tax profit of nearly $1 million. Also in that year, Gulf Interstate sold the Americana Building and its Buffalo [NY] properties. Although still primarily an engineering company, it continued to cast about for business opportunities. Gulf Interstate bought a stake in Northwest Pipeline Corporation. It undertook oil and gas exploration in Texas and Oklahoma through a subsidiary, Gulf Interstate Exploration, Inc....

Key Dates:

1953: Gulf Interstate Co. is formed as a pipeline engineering firm.

1959: Gulf Interstate goes public.

1983: The company changes its name to Gulf Applied Technologies.

1989: Shearson Lehman Hutton acquires a 30.5 percent stake.

1990: The marine division of Offshore Logistics is acquired.

1991: The company is renamed GulfMark International.

1997: The marine services division is spun off as GulfMark Offshore, Inc.

In 1960 Union Texas Natural Gas was formed and merged a year later with this same Allied Chemical. Renamed Union Texas Petroleum Division of Allied, its president, J. Howard Marshall II, went on the board of Allied Chemical. Born in Maryland in 1905, he became a Yale law professor while in his twenties and was soon chosen to work in FDR's Interior Department as oil coordinator. From that important position he moved back and forth between oil and gas corporations exploring in Saudi Arabia involving both California and Texas independent oil men and the federal government.

Marshall's name is most commonly known with what occurred in the last two years of his life; in 1994 at the age of 89 he married 26-year-old topless dancer and former Playboy "Playmate," Anna Nicole Smith.

One of the original tenants of the Central Square buildings was James Talcott Western, Inc., subsidiary of James Talcott, Inc., the country's largest independent industrial finance company, whose president since 1961 had been Henry R. Silverman. In 1973 the old factoring corporation was sold to Michele Sindona, an Italian banker.

Most of the other tenants were insurance companies, most no doubt connected to companies controlled by Cowling.

The tenants in the Americana Building which Gulf Interstate owned were somewhat different. Those tenants, among others, included

- the Consulate General of France andConsulate of Ecuador,

- Gulf Central Pipeline,

- Hunt Oil Co.,El Paso Natural Gas Building Co. (a Murchison company), and

- the Johnston Division of Schlumberger.

According to a deed dated January 6, 1963, the original leasehold had been created by First City Bank when it leased the building to Melvin Silverman and Bennett Rose in July 1956 with a simultaneous sublease to Foley's Department Stores (the company where Leopold Meyer spent his career) for parking in the basement and on the first five floors. The 1963 deed conveyed a 1/3 interest in the lease to Metropolitan Industries (a corporation owned by Ken & Ralph Schnitzer) pursuant to a partnership existing in 1961 when the leasehold was acquired by Gulf National. Fee title was held by First City National Bank, which was then controlled by "Suite 8-F" member, attorney James A. Elkins.

It was noted in newspaper articles in September 1973 that Gulf Interstate had sold its leasehold in the Americana Building. The actual transaction was structured with Gulf Interstate receiving a loan of $4.2 million from New York State Teachers Retirement System, then assigning the ground lease to Black Coral Investments, N.V., a Netherlands Antilles corporation, for a $1.2 million profit. This could very well have been either a money-laundering transaction or an attempt to avoid payment of taxes. In the exhibit to its Assignment of Leases, Gulf National Properties set out all the tenants of the building, including those listed above.

Gulf Interstate was also a partner with Schnitzer's Century Properties in the construction and management of the Houston Natural Gas Building. In a newspaper article in 1985, however, the Houston Natural Gas Building was said to be owned by Prudential Insurance and BP Pension Fund, although the core tenant which gave it the name by which it was known, was the Houston Natural Gas Co. (later to be known as Enron).

It was noted in newspaper articles in September 1973 that Gulf Interstate had sold its leasehold in the Americana Building. The actual transaction was structured with Gulf Interstate receiving a loan of $4.2 million from New York State Teachers Retirement System, then assigning the ground lease to Black Coral Investments, N.V., a Netherlands Antilles corporation, for a $1.2 million profit. This could very well have been either a money-laundering transaction or an attempt to avoid payment of taxes. In the exhibit to its Assignment of Leases, Gulf National Properties set out all the tenants of the building, including those listed above.

Gulf Interstate was also a partner with Schnitzer's Century Properties in the construction and management of the Houston Natural Gas Building. In a newspaper article in 1985, however, the Houston Natural Gas Building was said to be owned by Prudential Insurance and BP Pension Fund, although the core tenant which gave it the name by which it was known, was the Houston Natural Gas Co. (later to be known as Enron).

Houston Natural Gas also leased 23,600 square feet of space in the Americana Building and 80,000 square feet in the Continental Resources Building at 3040 Post Oak Blvd. The 1985 criss-cross directory showed the 5th floor of the Continental Resources building occupied by Florida Gas Transmission, a subsidiary of Enron, and the 8th floor by ANR Pipeline. Continental Resources was also an investor in the development of the Galleria.

Gulf Interstate also acquired a 20-acre industrial site near the Houston Ship Channel and a large block of undeveloped land in downtown Houston (for Houston Center, a commercial retail center developed by a joint venture between Texas Eastern and the Canadian group called Cadillac Fairview). This would connect it again to Brown & Root (located near the ship channel) and to the company called Texas Eastern, which developed the Houston Center in downtown Houston.

Gulf Interstate also acquired a 20-acre industrial site near the Houston Ship Channel and a large block of undeveloped land in downtown Houston (for Houston Center, a commercial retail center developed by a joint venture between Texas Eastern and the Canadian group called Cadillac Fairview). This would connect it again to Brown & Root (located near the ship channel) and to the company called Texas Eastern, which developed the Houston Center in downtown Houston.

Texas Eastern was a corporation set up primarily by George and Herman Brown and other members of the Suite 8F Crowd with financing put together by Dillon Read’s August Belmont IV. The development also included a new Gulf Building. The original office building occupied by Gulf Oil in Houston had been constructed by Jesse Jones, and the ground floor was occupied by Jones’ Texas Commerce Bank, which incidentally had merged with the bank set up by James A. Baker.

The major occupant of the Houston Center development was First City National Bank. In 1976 the Congressional Banking Committee which investigated foreign ownership of American banks discovered that First City Bank was largely owned by N.M. Rothschild of London. This bank had been founded by James A.Elkins, partner in the Vinson & Elkins law firm in which John Connally was later a partner. It should be remembered that Connally also owned a large block of stock in the Main Bank in Houston (housed in the vacated Humble Oil Building after that company built a new Exxon headquarters building). Connally (and CIA operative Jim Bath) sold Main Bank stock to Saudi investors who would later turn up in BCCI. It would later be learned that Jim Bath was fronting for a brother of Osama bin Ladin in other investments. Rumors were that he was doing so at the behest of CIA Director under President Gerald Ford, none other than Houston oil man George H. W. Bush.

Gulf Interstate’s president was Hy Byrd, who was also president of Central National Bank during 1963. In 1966 Hy Byrd and his wife, Gertrude, conveyed a tract of land which in 1928 had been owned by Houston Gas & Fuel--later called Entex before merging with Houston Natural Gas and Enron. Byrd had an office in the Houston Natural Gas Building. Also in 1966 Byrd sold his home in West Houston’s Tanglewood Sec. 8 to the Republic of France, possibly as a residence for the French Consulate which had an office in the Americana Building. Interestingly, Entex held the old University Savings as a wholly owned subsidiary. This S&L was chaired for a time by Bob Lanier, who would become Houston’s mayor in the 1990s. Lanier had also been president of the Main Bank and was also connected to Texas Gulf, a company which selected George H.W. Bush for its board after he was fired as CIA director by Jimmy Carter.

Another interesting connection to the Houston companies is Ann Bronfman, daughter of John L. Loeb, ex-wife of Edgar Bronfman, Sr. , who controlled the Cadillac Fairview Company mentioned earlier. She (along with a number of investors named Loeb, Kempner, Levin, Cohen and Gimbel with Park Avenue, New York addresses) was a partner in a joint venture called GIX Associates with Gulf Interstate Exploration Co. of Houston and Norco Investments Co. of Washington, D.C. in 1983. Norco (perhaps coincidentally) is the name of a refinery in New Orleans owned at one time by Shell Oil. In Stephen Birmingham's book, Our Crowd, he states:

, who controlled the Cadillac Fairview Company mentioned earlier. She (along with a number of investors named Loeb, Kempner, Levin, Cohen and Gimbel with Park Avenue, New York addresses) was a partner in a joint venture called GIX Associates with Gulf Interstate Exploration Co. of Houston and Norco Investments Co. of Washington, D.C. in 1983. Norco (perhaps coincidentally) is the name of a refinery in New Orleans owned at one time by Shell Oil. In Stephen Birmingham's book, Our Crowd, he states:

[1] According to a trustee's deed resulting from a foreclosure conducted by William Ladin pertaining to a loan to Anthony Luciano [B498509].

[2] Houston: A Profile of Its Business, Industry and Port, 1982. An article appeared in the Houston Chronicle on September 13, 1973, announcing that Gulf Interstate had signed a 25-year contract to design, build and operate a fuel oil terminal on the Delaware River near Wilmington, marking the company's "entry into the commercial terminaling business." The Delaware terminal was to have a deepwater dock capable of handling tankers up to 50,000 tons. This is interesting because of Kenneth Schnitzer's connection to Gulf Interstate and his involvement in the Port of Houston.

[3] Stephen Birmingham, "Our Crowd": The Great Jewish Families of New York (New York: Dell 1967), pp. 444-45.

The major occupant of the Houston Center development was First City National Bank. In 1976 the Congressional Banking Committee which investigated foreign ownership of American banks discovered that First City Bank was largely owned by N.M. Rothschild of London. This bank had been founded by James A.Elkins, partner in the Vinson & Elkins law firm in which John Connally was later a partner. It should be remembered that Connally also owned a large block of stock in the Main Bank in Houston (housed in the vacated Humble Oil Building after that company built a new Exxon headquarters building). Connally (and CIA operative Jim Bath) sold Main Bank stock to Saudi investors who would later turn up in BCCI. It would later be learned that Jim Bath was fronting for a brother of Osama bin Ladin in other investments. Rumors were that he was doing so at the behest of CIA Director under President Gerald Ford, none other than Houston oil man George H. W. Bush.

Gulf Interstate’s president was Hy Byrd, who was also president of Central National Bank during 1963. In 1966 Hy Byrd and his wife, Gertrude, conveyed a tract of land which in 1928 had been owned by Houston Gas & Fuel--later called Entex before merging with Houston Natural Gas and Enron. Byrd had an office in the Houston Natural Gas Building. Also in 1966 Byrd sold his home in West Houston’s Tanglewood Sec. 8 to the Republic of France, possibly as a residence for the French Consulate which had an office in the Americana Building. Interestingly, Entex held the old University Savings as a wholly owned subsidiary. This S&L was chaired for a time by Bob Lanier, who would become Houston’s mayor in the 1990s. Lanier had also been president of the Main Bank and was also connected to Texas Gulf, a company which selected George H.W. Bush for its board after he was fired as CIA director by Jimmy Carter.

Another interesting connection to the Houston companies is Ann Bronfman, daughter of John L. Loeb, ex-wife of Edgar Bronfman, Sr.

, who controlled the Cadillac Fairview Company mentioned earlier. She (along with a number of investors named Loeb, Kempner, Levin, Cohen and Gimbel with Park Avenue, New York addresses) was a partner in a joint venture called GIX Associates with Gulf Interstate Exploration Co. of Houston and Norco Investments Co. of Washington, D.C. in 1983. Norco (perhaps coincidentally) is the name of a refinery in New Orleans owned at one time by Shell Oil. In Stephen Birmingham's book, Our Crowd, he states:

, who controlled the Cadillac Fairview Company mentioned earlier. She (along with a number of investors named Loeb, Kempner, Levin, Cohen and Gimbel with Park Avenue, New York addresses) was a partner in a joint venture called GIX Associates with Gulf Interstate Exploration Co. of Houston and Norco Investments Co. of Washington, D.C. in 1983. Norco (perhaps coincidentally) is the name of a refinery in New Orleans owned at one time by Shell Oil. In Stephen Birmingham's book, Our Crowd, he states: Just as the Lehmans had secured their position [on the New York Stock Exchange] by marrying Goodharts and Lewisohns, so John L. Loeb secured his by marrying a Lehman--the youngest daughter of the Arthur Lehmans, Frances. . . . One sister was married to Richard Bernhard, a partner at Wertheim & Company. Another married Benjamin Buttenwieser, still one of the most important partners at Kuhn, Loeb.

John Loeb's new firm opened its doors in January, 1931. Six years later, through a merger with Rhoades & Company, an old gentile firm that needed money, the Loebs' firm, which needed a prestige name, became Carl M. Loeb, Rhoades & Company. Like his banking predecessors, John Loeb has kept his house tightly "in the family," employing among others, his son, John Loeb, Jr., a nephew, Thomas Kempner, and until his recent death, a son-in-law, Richard Beaty, as Loeb, Rhoades partners. . . .

Thanks to antennae around the world that amount to something very like a private CIA, he completed the sale of the firm's major Cuban sugar holdings the day before Fidel Castro took over. In 1945 the Loeb and Lehman millions received a new infusion of wealth when Clifford W. Michel joined Loeb, Rhodes. Michel was married to the former Barbara Richards, one of the granddaughters of Jules Bache, and therefore related to the Cahns and the Sheftels and, by marriage at least, to the Lewisohns (to whom the Lehmans, of course, were already related). Another Bache granddaughter was Mrs. F. Warren Pershing, wife of the son of the World War I general, and head of J. Pershing & Company, a rich brokerage house.

United Fruit - Empire Trust

Then in 1953 John Loeb's daughter, Ann, married Edgar Bronfman, elder son of Samuel Bronfman, the founder and chief executive of Distillers Corporation--Seagrams, Ltd., undoubtedly the richest man in Canada and among the wealthiest in the world. Bronfman money is not formally a part of Loeb, Rhoades capital, but one of the firm's partners has said, "He's a kind of partner who is awfully important." . . . The Bronfman millions, however, have joined Loeb-Lehman and Bache holdings to make up the largest single holding of stock in New York's Empire Trust CompanyENDNOTES:, which has assets of some $300 million. Edgar Bronfman, now [1967] in his middle thirties, and head of his father's American subsidiary, Joseph E. Seagram & Sons, joined the board of directors of the Empire Trust Company in 1963. . . .[3]

[1] According to a trustee's deed resulting from a foreclosure conducted by William Ladin pertaining to a loan to Anthony Luciano [B498509].

[2] Houston: A Profile of Its Business, Industry and Port, 1982. An article appeared in the Houston Chronicle on September 13, 1973, announcing that Gulf Interstate had signed a 25-year contract to design, build and operate a fuel oil terminal on the Delaware River near Wilmington, marking the company's "entry into the commercial terminaling business." The Delaware terminal was to have a deepwater dock capable of handling tankers up to 50,000 tons. This is interesting because of Kenneth Schnitzer's connection to Gulf Interstate and his involvement in the Port of Houston.

[3] Stephen Birmingham, "Our Crowd": The Great Jewish Families of New York (New York: Dell 1967), pp. 444-45.

1 comment:

For those who do not know, tragically Odie Seagraves died January 19, 1970 at the age of 84 by falling from the 8th floor from a Dallas hotel, in an apparent suicide. He had been found guilty of stealing secret oil exploration maps and accused of manipulating stocks on the NY exchanges. Convicted in 1958 and fined $5,000.

Post a Comment