Sensing the End of the Gold Standard

Connecting these seemingly disparate events is another Texan -- President Eisenhower's favorite--Secretary of Treasury Robert Bernard Anderson--who had long been John Connally's business and financial mentor. Anderson taught Connally that oil and money, unlike oil and water, do in fact mix quite well.

Even before meeting Eisenhower, however, Anderson had been selected by President Truman during the closing days of WWII to deal with a national security matter--how to use gold confiscated from war enemies to shore up U.S. gold reserves underlying the Bretton Woods Agreement. Sterling Seagrave wrote in 2008, describing those earlier events:

Stimson’s special assistants on this topic were his deputies John J. McCloy and Robert [A.] Lovett, and consultant Robert B. Anderson, all clever men with outstanding careers in public service and banking. McCloy later became head of the World Bank, Lovett secretary of Defense, Anderson secretary of the Treasury. Their solution was to set up what is informally called the Black Eagle Trust. The idea was first discussed with America’s allies in secret during July 1944, when forty-four nations met at Bretton Woods, New Hampshire, to plan the postwar world economy. (This was confirmed, in documents we obtained, by a number of high-level sources, including a CIA officer based in Manila, and former CIA Deputy Director Ray Cline, who knew of Santy’s recoveries in 1945. As recently as the 1990s, Cline continued to be involved in attempts to control Japanese war-gold still in the vaults of Citibank.)

After briefing President Truman and others in Washington, including McCloy, Lovett, and Stimson, Captain [Edward G.] Lansdale returned to Tokyo in November 1945 with Robert B. Anderson. General MacArthur then accompanied Anderson and Lansdale on a covert flight to Manila, where they set out for a tour of the vaults Santy already had opened. In them, we were told, Anderson and MacArthur strolled down "row after row of gold bars stacked two meters tall." From what they saw, it was evident that over a period of 50 years (1895-1945) Japan had looted many billions of dollars in treasure from all over Asia. A far longer period than Germany had to loot Europe. Over five decades, Japan had looted billions of dollars’ worth of gold, platinum, diamonds, and other treasure, from all over East and Southeast Asia. Much of this had reached Japan by sea, or overland from China through Korea. What was seen by Anderson and MacArthur was only some of the gold that had not reached Japan after 1943, when the US submarine blockade of the Home Islands became effective. From this it is obvious that what was looted by Japan on the Asian mainland from 1895-1943 had reached Japan and been tucked away there in what the US Army statement called "undeclared caches of these treasures ... known to exist."

Far from being bankrupted by the war, Japan had been greatly enriched, and -- thanks to Washington’s intervention -- used this treasure to rise like a phoenix from the ashes, while its victims struggled on for decades.

The gold recovered in the Philippines was not put in Fort Knox to benefit American citizens. There has been no audit of Ft. Knox since 1950.

According to Ray Cline and others, between 1945 and 1947 the gold bullion recovered by Santy and Lansdale was discreetly moved by ship to 176 accounts at banks in 42 countries. The gold was trucked to warehouses at the U.S. Navy base in Subic Bay, or the U.S. Air Force base at Clark Field.

Preference went to the U.S. Navy because of the weight of the bullion. Secrecy was vital. If the recovery of a huge mass of stolen gold became known, the market price of gold would plummet, and thousands of people would come forward to claim it, and Washington would be bogged down resolving ownership.

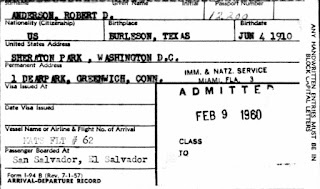

The secrecy surrounding these recoveries was total. Robert Anderson and CIA agent Paul Helliwell traveled all over the planet, setting up these black gold accounts, providing money for political action funds throughout the noncommunist world. In 1953, to reward him, President Eisenhower nominated Anderson to a Cabinet post as secretary of the Navy. The following year he rose to deputy secretary of Defense. During the second Eisenhower Administration, he became secretary of the Treasury, serving from 1957 to 1961. After that, Anderson resumed private life, but remained intimately involved with the CIA’s worldwide network of "black banks," set up by Paul Helliwell. Eventually, this led to Anderson being involved in the scandal of BCCI, the Bank of Credit and Commerce International, a Pakistani bank with CIA ties.

Robert B. Anderson and Greenwich

Anderson had resigned from Ike's defense department in 1955 to take a job with Thayer Lindsley of the Canadian gold mining company called Ventures, Limited. Based in New York, Anderson commuted from his new home at No. 1, Deer Park Court in Greenwich, Connecticut--about a mile and a half from Prescott Bush's residence--as marked on our Greenwich map made for another post at this blog.

|

| Greenwich, CT--Rockefeller family, owners of Citibank stock, controllers of NY Fed |

Less than a year after that award, President Eisenhower summoned Anderson back to Washington (June 1957) to replace George Humphrey as Secretary of Treasury, an appointment Senator Prescott Bush applauded. After Anderson left the Treasury Department, however, rather than going back to Texas, or running for President, as Ike had had wanted him to do, he instead returned to his adopted home in Greenwich, Connecticut. Many years later, when his wife, Ollie Mae, died in May 1987, her address was given as 682 Lake Avenue, still in Greenwich.

In 1962 Anderson was serving on the board of the State National Bank of Connecticut, as a director alongside G.H. (Herbie) Walker, Jr. and Samuel Pryor. He was also on the 12-man Board of Dresser Industries, alongside Texas governor Allan Shivers, Norman Chandler of the L.A. Times, Lewis MacNaughton (partner of geologist Everett DeGolyer), and Neil Mallon. In 1964, however, Anderson supported his old friend Lyndon Johnson for re-election instead of Bush's favored Goldwater.

Herbie Walker, an uncle of George H. W. "Poppy" Bush, was the man who raised money from investors for his nephew's first oil company in the West Texas oil field in the early 1950's. Uncle Herbie, Dorothy Walker Bush's brother, had risen to the head of the Walker family following the death of Bert Walker in 1953. [Search this blog for "George Herbert Walker" for other articles.]

G. H. Walker was the first president of W.A. Harriman & Co. in New York appointed by the young Harriman boys when it opened in 1920, long before the investment bank merged with Brown Brothers in 1931.Had the elder Walker chosen his grandson, "Poppy" Bush, to be David K.E. Bruce's protégé? Aviation Corporation (AVCO), where Bruce had been president, was also a creation of W. Averell Harriman. When Bruce then left AVCO in 1929 and returned to the foreign service, it was at the behest of Prescott Bush's partner at Brown Brothers Harriman--W. Averell Harriman. As I have stated before:

It is Prescott’s entry into partnership in the newly created investment bank of Brown Brothers Harriman (BBH), which best explains how his sons and grandsons attained their access to capital. BBH began doing business in 1931, as a result of a merger between the old, well-established Brown Brothers & Co. and W.A. Harriman & Co., a deal put together by Prescott Bush's father-in-law on behalf of the sons of railroad tycoon E.H. Harriman, who had been Prescott's Skull and Bones brothers while they were all at Yale during the years just prior to WWI.

Renaissance and Aeneas--1993

The

same year Renaissance Technologies made an investment in a company that

modified an invention made for the medical industry for use petroleum

exploration it hired Robert Mercer and others from IBM

who had long been studying speech recognition and machine translation,

"computational linguistics." RenTec partnered with Aeneas Venture Corp.,

which five years earlier had poured money into Harken Energy, in the

purchase in 1993 of Numar, a Pennsylvania corporation which developed medical technology for use in the oil industry (see inset right).

The

same year Renaissance Technologies made an investment in a company that

modified an invention made for the medical industry for use petroleum

exploration it hired Robert Mercer and others from IBM

who had long been studying speech recognition and machine translation,

"computational linguistics." RenTec partnered with Aeneas Venture Corp.,

which five years earlier had poured money into Harken Energy, in the

purchase in 1993 of Numar, a Pennsylvania corporation which developed medical technology for use in the oil industry (see inset right).Four years later, Numar would be acquired by Halliburton, whose chief executive, Dick Cheney, handled the deal for the Dallas-based corporation , whose other executives--Anne Armstrong and lawyers at John Connally's Vinson & Elkins--had implemented the terms. Connally and Armstrong had been part of the Nixon administration, with Armstrong and Cheney surviving into Gerald Ford's presidency (1974-76), during the same time Bush 41 was Director of the CIA.

Numar received Halliburton stock valued at $472 million in exchange for its own stock, making the purchase price $360 million. According to Bloomberg:

In September 1997, NUMAR Corporation was acquired by Halliburton Company, through the merger of a subsidiary of Halliburton with and into NUMAR. Previously, NUMAR Corporation was engaged in the design, manufacture, and marketing of a patented, proprietary well logging device, used in medical diagnostic imaging devices, to evaluate subsurface rock formations in newly-drilled oil and gas wells.Three years after the Halliburton deal, Cheney was elected vice president under George W. Bush (43), who had been the primary beneficiary of the Aeneas Venture Corporation's 1988 Harken transaction.

|

| George W. Bush was a director of Harken with Alan Quasha, Mikel Faulkner, and Michael Eisenson before 1993. |

Though Renaissance Technologies had not been involved in the 1988 Bush transaction, there were certain aspects surrounding an investment Simons' former company, Monemetrics, had made years earlier that rang a reminiscent bell. Knowing that Harvard-educated Alan G. Quasha had purchased Harken stock for Quadrant Capital Corp. by using entities in Tortola, British Virgin Islands, held in trust by his mother, Phyllis Grant Quasha, an Australian citizen, I began to wonder whether Ivory Limited, set up in the British Virgin Islands, a limited investor in a 1981 partnership between Simons' Monemetrics Corp. and Doral Industries (headed by Norman Melnick). It appeared that Melnick wanted to buy the Magic Marker trademark, a bankruptcy asset of his former employer, and. According to Bloomberg's cache: "He was an early adopter of outsourcing manufacturing to China."

Alan Quasha is said to have created Quadrant Management in 1988, the same year he went to work for Compagnie Financière Richemont SA., but he admitted in an interview that he began doing "restructurings" as early as 1979. Was Doral Industries, Simons' partnership with Norman Melnick, one of those restructurings which brought in capital from his father's law firm?

Did Melnick and Simons obtain the needed capital, by chance, from a client of Alan Quasha's father, attorney William Quasha, who was still practicing law in Manila in 1981? Could the capital infusion from the secret Ivory Ltd. account in the British Virgin Islands have been arranged by Quasha Ancheta Pena & Nolasco, whose website proclaims the firm was "originally founded in 1946 ... as William H. Quasha and Associates." Had Simons crossed paths while he was at Harvard with Alan Quasha? Those are questions for other researchers to answer.

The Quasha Family

Nevertheless, those questions only led us to seek answers to other inquiries, concerning how Renaissance Technologies may have discovered the opportunity to join with Aeneas in 1993. Our first step was to learn more about the Quasha family. The two sons, Alan Grant Quasha and Wayne Quasha, attended the Hill School in Pottstown, Pennsylvania, where Wayne was on the baseball team and was editor of the Hill News student paper in the mid 1960s. Alan played tennis at the Hill School in 1968, and at Harvard he would be on the squash team in 1972. He spent most of the 1970s at Harvard, obtaining an MBA from Harvard Business School while graduating later from Harvard Law School.

In 1976 Alan was working as an associate with the New York law firm of Davis, Polk & Wardwell when he joined New York's Union Club. He did not move back to his father's law firm--then known as Quasha, Asperilla, Zafra, Tavag & Ancheta--with offices in Manila and Bangkok, Thailand. Instead, in 1977 he married Diana Vinade Ronan, a debutante daughter of a powerful businessman with close connections to the Rockefeller family.

Dr. William J. Ronan was chairman of the Port Authority of New York and New Jersey and a "senior adviser to the Rockefeller family." He was former dean of the Graduate School of Public Administration at New York University, having been affiliated with that school since as early as 1939, the year he married Ellen Vinade. He had also been chief executive officer of the Metropolitan Transportation Authority for a time.

Alan Quasha completed an advanced degree in taxation in 1980 at the NYU Law School, where his father-in-law was dean. He was then primed to start his career, while getting one more advanced law degree from Harvard. That was the year Ted Koppel reminded us every night how many days Americans seized by students in Teheran had been held as hostages by Ayatollah Khomeini, while President Jimmy Carter holed up in the White House, refusing to campaign while the hostages were not free. Republicans were hopeful about reclaiming the presidency, and seven of them actively campaigned. After George H. W. Bush's withdrawal in late May, Ronald Reagan named him as his running mate. But still Carter, competing in Democratic primaries against Ted Kennedy and Jerry Brown, did not campaign.

Gasoline prices skyrocketed, and there were long lines at the pumps. Anger was rife, and conspiracies were suspected, especially after the attempted April rescue mission (Operation Eagle Claw) failed. Wayne Madsen in 2015, analyzing declassified documents, stated the failure of the mission occurred because two Republican candidates were operating two separate spy operations, using "moles within the National Security Council," and passing stolen classified intelligence to Richard H. Allen, William Casey, Ed Meese, or Judge William Clark. Four days before the mission, Miles Copeland, an old Kermit "Kim" Roosevelt CIA hand, leaked news of the mission in the Washington Times. Madsen called these leaks of highly classified documents and other acts "high-level treason ... not a mere policy difference," against the United States.

Harken

The Harken founders were account executives for the investment banking firm of White Weld & Co., a brokerage firm destined to merge with G. H. Walker & Co. in 1974, thus removing the Walker name from the securities industry. In April 1978 White, Weld Credit Suisse would be snatched up by Merrill, Lynch, and its name would also disappear from history. Harry L. Mulligan and Phil Kendrick, Jr.--whose names when combined spelled Harken--first set up this company in California in 1973 before relocating to Texas. Phil Jr.'s father was an oilman in Abilene, Texas, and Phil Jr. graduated in 1950 from the University of Texas. After he sold his father's oil company a decade later, he moved to New York to work for White, Weld & Co.,

|

| Reprint of Jack Z. Smith Harken story |

Kendrick and Mulligan formed Harken in Pasadena, California in July 1973 while its founders were still working for White, Weld. At that same time they had set up a number of limited partnerships designated K&M Exploration. The partnerships were drafted at 555 South Flower Street in the office of Latham & Watkins, the law firm which represented the Richfield Oil Company in Los Angeles, which had its headquarters in the same building.

White, Weld & Co., which handled securities matters for Richfield, was then in the process of absorbing G.H. Walker & Co., removing the latter's name from its letterhead in November 1974, when the merger with the investment bank founded by Bush 41's grandfather was concluded.

|

| Uncle Herbie |

At first Kendrick worked from his home in Pasadena, while his partner Harry Mulligan, Jr. worked in New Haven. They moved to Abilene a year later, from which they operated Harken for five years, drilling more than 300 wells, primarily in Texas and Oklahoma. Kendrick spent those years watching Australia, he told David Armstrong, in the hope he could find an opportunity to explore for oil there.

It was a year of upheaval on many fronts--especially political and financial. In 1973 George Bush 41 was at the Republican National Committee, CREEP having completed its mission of reelecting Nixon. Bush held Richard Nixon's nervous hand, finally telling Nixon when it was time to resign, and likely arranged for the pardon by President Gerald Ford in order to ensure that Nixon would keep quiet about the Watergate burglary and the "plumbers." 1974 was the same year Henrik Kruger wrote that the "heroin coup" was complete. And it was also the year most of the large investment banks (partnerships with accountability) began to consolidate their portfolios and go public, thus removing themselves from responsibility for their bad decisions.

Robert Mercer's Black-box, Computer-Driven Algorithms

1986 the Chicago Tribune published a story which indicated that IBM was a decade away from technology that would allow one computer to talk to another. Robert Mercer, manager of the IBM Thomas J. Watson Center in Yorktown Heights, New York's real time speech recognition department, was quoted.

A West Texan by birth, I myself have driven through Abilene dozens of times in my life. It is a dusty Texas city lying at the point of intersection between two lines:

- one line between Lubbock and Waco and

- a second between Midland and Fort Worth.

Whether members of the Potter family had ever crossed paths with the Bush family in Midland is not known, although we do know that Faulkner would likely have been working on his MBA at Harvard at about the same time as George W. Bush, who received his degree in 1975, seven years after his Yale undergraduate degree was awarded.

However, at the time Dubya purchased his Texas Rangers baseball team stock in the fall of 1989, he was not only acting as an energy consultant for Harken, but he was its largest shareholder. The baseball syndicate buyers also included Richard E. Rainwater of Fort Worth and William O. DeWitt Jr. of Cincinnati. Rainwater, named as a partner with Bass Enterprises and Sid Bass in television station KFDA as early as 1976, had handled Bass brothers' stock portfolio while he was at Goldman Sachs, and was still advising the Basses until 1986. The Bass brothers' mother was the late Sid Richardson's sister and only legal heir.

It was therefore likely that Bush brought in Alan Quasha to buy into Harken in 1981-82. Mikel Dean Faulkner had been a 1971 magna cum laude graduate of Abilene Christian College in Harken-founder Kendrick's hometown, had studied mathematics there before serving in the Navy's nuclear power program which trained officers to operate nuclear submarines. Either Kendrick or someone else recruited him in 1981 to become Harken's president to run the company which was then in the process of being sold to some individuals Kendrick had met while drilling for oil in Australia.

Mikel Faulkner decided to leave his job as accountant for American Quasar Petroleum Co. to work for Harken. American Quasar Petroleum was originally incorporated in Florida and was leasing land from the Miccosukee Tribe for exploration in 1981 with San Antonio, Texas, based Tesoro Petroleum. Tesoro was founded by Robert Van Osdell West, Jr., who had a Ph.D. from the University of Texas when first employed as a petroleum engineer in Midland in 1949 by Tom Slick of San Antonio. West worked for Slick's companies until his death in October 1962, at which time he bought TexStar Corporation, renaming it Tesoro, from which he retired in 1992. He died in 2006.

After creating Tesoro, West had grown rapidly and by November 1973 was negotiating with an "unnamed Arab potentate" to drill on Arab soil. In those eleven years he had already moved his drilling equipment into Alaska, Trinidad and Indonesia. By the next year, he was giving speeches against U.S. government policy under President Gerald Ford.

Under Faulkner's helm a few years later Harken bought a corporation founded by another accountant from Abilene, G. Randy Nicholson, a trustee of Faulkner's alma mater Abilene Christian College since 1981. Nicholson had created E-Z Serve gas stations and convenience stores based upon a technology he invented for gas pumps installed with credit card readers which transmitted information to a computer database, thus avoiding the need for human interaction. Harken soon increased its revenue by 9600%! In 1990 Donald M. Smith exclaimed [in the National Petroleum News (Jan 1990 v82 n1), p42] that Harken's:

financial growth has been nothing short of spectacular--from a few million dollars in annual sales in 1986 to gross revenues expected to be in the $1-billion range this year.

One sign of Harken's growing eminence occurred on August 30 when the company's stock began trading on the New York Stock Exchange under the symbol HEC.... Overall, the company's financial performance has been startling. In 1986, Harken Oil & Gas, Inc. (the name was changed to Harken Energy Corp. on Jan. 1, 1989 to reflect its broader industry profile) had total revenues of only $4.4-million. In 1987, following the acquisition of E-Z Serve in December 1986, the company's revenues jumped an astonishing 9,600% to $421-million....

As described in the company's own financial pronouncements, Harken "acquires, restructures and manages energy assets for itself, other energy companies and financial institutions." As such, the company's growth strategy differs somewhat from many other oil companies in that the principal building blocks of its growth, so far at least, have been through acquisitions and not based on internal expansion.

Also rather unique among the larger Sunbelt-based independents is the fact that Harken's top two officers, Mikel D. Faulkner, president and CEO, and Alan G. Quasha, chairman, have financial and legal rather than operational oil company backgrounds. Faulkner, 40, is a certified public accountant with a master's degree in business administration [Though his undergrad degree was in mathematics and physics]. Quasha, also 40, is a New York attorney and specialist in corporate reorganizations....

Faulkner, a Church of Christ deacon known for both his straightforward honesty and shrewdness, joined Harken from Fort Worth-based American Quasar Petroleum (now Wolverine Exploration Co.) where he was controller. Prior to that he was with the Arthur Anderson & Co. accounting firm in Dallas for several years.

Quasha, a partner in the law firm of Quasha, Wessely & Schneider, New York, is also chairman of Frontier Holding Inc. and played a big role in restructuring Denver-based Frontier Oil and Refining Co. several years back [NPN--Jan. '88, p15].

Faulkner signed on at Harken in 1981 and became chief executive in 1982 following a management shakeup. With the company facing bankruptcy, he laid off 90 of its 100 employees, sold 25% of the company's oil field assets for $5-million and then used that sum to negotiate new terms with creditors. In 1982, Harken had a debt load of $20-million; in 1983, it was debt-free....

In all, Harken has scooped up about a dozen companies since 1983, acquiring both petroleum marketing firms and oil and gas properties and boosting its $20-million 1983 asset base fourteen-fold by midyear 1989....

Another acquisition, that of Spectrum 7 Energy Corp. in 1986, brought George W. Bush Jr., the president's son, on board as a director....Donald Smith's analysis in 1990 ignored the fact that a total of 30% of Harken Energy stock, valued at $28 million, as Harvard had only recently learned from SEC filings, according to the May 1991 Harvard Crimson, was held by the Harvard endowment. That fact, however, would quickly become a matter of concern because of the apparent conflict of interest that existed because two managers of Harvard-affiliated entity Aeneas also had personal investments in Harken--10,000 shares each held by Michael R. Eisenson and Donald D. Beane. The Crimson repeatedly reported its concern, while Harvard itself denied that the investment was improper.

SEC documents which revealed the conflict of interest were not filed until eight months after George W. Bush (later President Bush 43) sold 66% of his Harken stock for $848,560. That was the source of the money with which he repaid loans created when he bought his share of the Texas Rangers baseball team. He had sold just in the nick of time, only "two months before the corporation announced a $23 million loss," as the Crimson reported in 2002. Harvard had come under a great deal of scrutiny before that 2002 report because of research that Catherine Austin Fitts was doing following the collapse of Enron in 2001, which occurred only one month after the 9/11 debacle. Working with Fitts, I had written up research that appeared in 2002 called "Follow the Yellow Brick Road: From Harvard to Enron" to assist her in determining who had caused her own company, Hamilton Securities Group, to tank in 1996.

Although most of our research turned on Pug Winokur's career, Mike Eisenson was also of interest because he was one of two men who told Fitts in 1990 that 20% of the equity in Hamilton, a company initially founded to give contract advice to Pug Winokur's company, NHP, Inc. (formerly National Housing Partnership), in which Harvard also had a large investment, would be owned by NHP. Fitts, feeling extortion was at play, refused to agree to the kickback scheme and was consequently advised by Eisenson that the verbal contract she had made with Winokur would be abrogated. Fitts, however, believing Hamilton could still offer a valuable service without NHP's consulting contract, proceeded to set up her company without Harvard's participation.

Two years prior to this discussion, Winokur had been at DynCorp, but in 1995 joined the board of Harvard Management Corporation, the board with oversees Harvard's overall endowment. In the late summer of 1995 NHP completed its IPO, repaying loans to venture capital entities affiliated with Harvard, such as Demeter and Capricorn.

My main contribution was in offering an historical perspective concerning what I knew about Harvard's original founding and the investments made by earlier capitalists whose fortunes had been made in "the China trade," or what I felt was a euphemism for the drug trade of the 1840's. That article was posted to the internet by a friend of an acquaintance, and its now-dead links were cited and referred to as a "far more controversial take," by a Harvard Watch group. But the work we did attempting to understand how the money worked did wake people up and gain attention about how incestuous tax-exempt entities really are.

In 1988 members of the syndicate investing in Harken did not include Quasha by name. Aeneas Venture Corp. owned 22% of Harken as early as 1989, the year Malcolm Berko reported that "George Sporos (no relation to 'Sporos' Agnew), a renowned, astute and shrewd money manager," also owned 22% of the stock in Harken. Another large owner was then the Union Bank of Switzerland, whose stock made the aggregate ownership of these four, including Bush, at more than 50%. George Soros, also a shrewd and savvy money manager, was accurately identified in a 1988 article, written by Jack Z. Smith of the Fort Worth Star Telegram, cited in Donald Smith's article, as the real owner. So much for Berko's expertise!

In October 1991, Horn & Hardart was taken over by North American Resources (NAR Group Limited), which included members of the Quasha family and a Swiss financial firm. The name was changed to Hanover Direct, a catalog retailing business with headquarters in Weehawken, New Jersey. The Swiss firm was Richemont Finance S.A. ("Richemont"), a Luxembourg company, owning about 49% of Hanover's common stock. Richemont was a wholly owned subsidiary of Compagnie Financiere Richemont, A.G., a Swiss public company engaged in luxury goods, tobacco and other business on behalf of its owner South African citizen Anton Rupert, who died in 2006. His son Johann Peter Rupert also worked in the same companies. The offshore havens were used to hide their South African ownership because of global embargoes against the apartheid government.

NAR was also affiliated with Intercontinental Mining & Resources Incorporated, to which it had executed a subordinated $10 million promissory note in 1996. Since Hanover owned both NAR and IMR, the note was surrendered to and cancelled by Hanover.

Harken's 1994 shareholders were reported to include the following:

- Renaissance Technologies.

- Aeneas Venture Partners, an entity affiliated with capital managed by a Harvard University endowment fund. According to a 1994 SEC filing Aeneas was holding 25,000 shares of Common Stock subject to stock options transferred to it by Michael R. Eisenson, a Director of Harken, effective March 1, 1991.

- Aeneas Venture Partners also held as trustee or nominee another 468,367 shares of Common Stock owned beneficially by the Harvard Master Trust [the pension plan for Harvard University]. Aeneas has no investment or voting power over these shares.

- Aeneas Venture Partners held another 234,204 shares of Common Stock owned beneficially by the Harvard Yenching Institute. Aeneas has no investment or voting power over these shares.

- Aeneas Venture Partners 321,679 shares of Common Stock owned beneficially by Phemus Corporation, all of which parties are affiliates of Aeneas.

|

| MRI technology (Numar) developed for oil industry. |

"BCCI was the Bank of Credit and Commerce International, a dirty offshore bank that then-president Ronald Reagan’s Central Intelligence Agency used to run guns to Hussein, finance Osama bin Laden, move money in the illegal Iran-Contra operation and carry out other “agency” black ops. The Bushes also benefited privately; one of the bank’s largest Saudi investors helped bail out George W. Bush’s troubled oil investments."Russ Baker in his book, Family of Secrets, also explored the provenance of the funds that made their way into Harken. George Walker Bush joined the Harken board in September 1986, the same time Harken purchased Spectrum 7 Energy, a William DeWitt, Jr. and Mercer Reynolds company which merged with Bush's Arbusto Energy two years earlier. Bush had founded Arbusto in 1978.

A letter submitted by Alan G. Quasha to editors of The Nation in 2007 appears to agree with Baker's evaluation that he understood very little. Quasha stated in part about various allegations made in Family of Secrets and and article that appeared in The Nation, called“Hillary’s Mystery Money Men”:

"The insinuations against Harken Energy are false. When I was nonexecutive chairman, Harken’s major shareholders were George Soros, Harvard University and a joint venture I headed; none had ties with “BCCI,” “Saudi frontmen,” “a foreign dictator” or “figures with intelligence ties.”Baker and Adam Federman, who authored the Hillary article, vigorously rebutted Quasha's attack on their credibility.

~~~~~~~~~~~

"Saudi Arabia: Creation of the Petrodollar" has been in draft form for several years, being added to and edited as time permitted. Please refer to other articles in my Quixotic Joust blog which are linked above, including the following:

Being the House Player at the Casino.

Who is Robert Mercer Really?

Remembering the Harken Money.